views

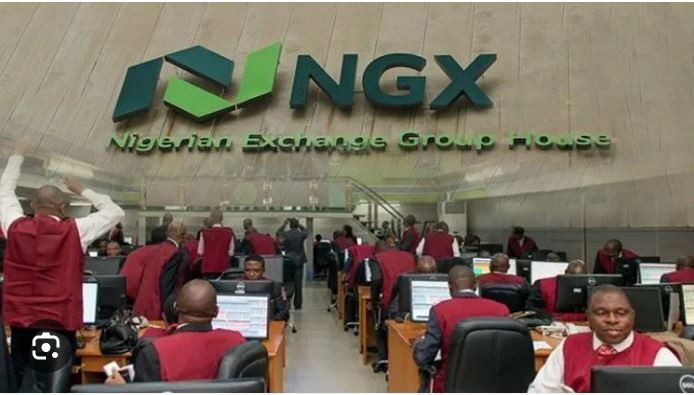

The Nigerian Exchange Limited has expressed its support for FCMB Group Plc’s plan to raise N110.9bn through a public offering.

FCMB Group commenced its public offer of 15.197 billion shares at N7.30 per share on July 29 and will close on September 4.

According to a statement made available to our correspondent on Thursday, the capital raise is aimed at bolstering the group’s operational capacity and supporting its growth initiatives.

The FCMB Group Chief Executive, Ladi Balogun, stated that despite challenging economic conditions, the bank had maintained strong performance metrics, including revenue growth and profitability.

The Group Chief Executive Officer of the Nigerian Exchange Group, Temi Popoola, lauded FCMB’s initiative, emphasising the exchange’s support for the capital raise.

He noted that FCMB’s digital innovations around the public offer aligned with NGX’s digital transformation goals.

Comments

0 comment